Fabrice Dubois

Founder & Managing Partner

Venture Wise Partners is a values-driven investment firm focused on acquiring and growing resilient small businesses in South Florida and Texas.We partner directly with owners who care about what happens after they step away. Our process is discreet, professional, and built to protect your team, customers, and reputation.We bring hands-on business development and operations experience across manufacturing, logistics, home services, and finance. We focus on practical improvements that strengthen cash flow, systems, and leadership without breaking what already works.If you’re thinking about an exit now or later, let’s talk confidentially.

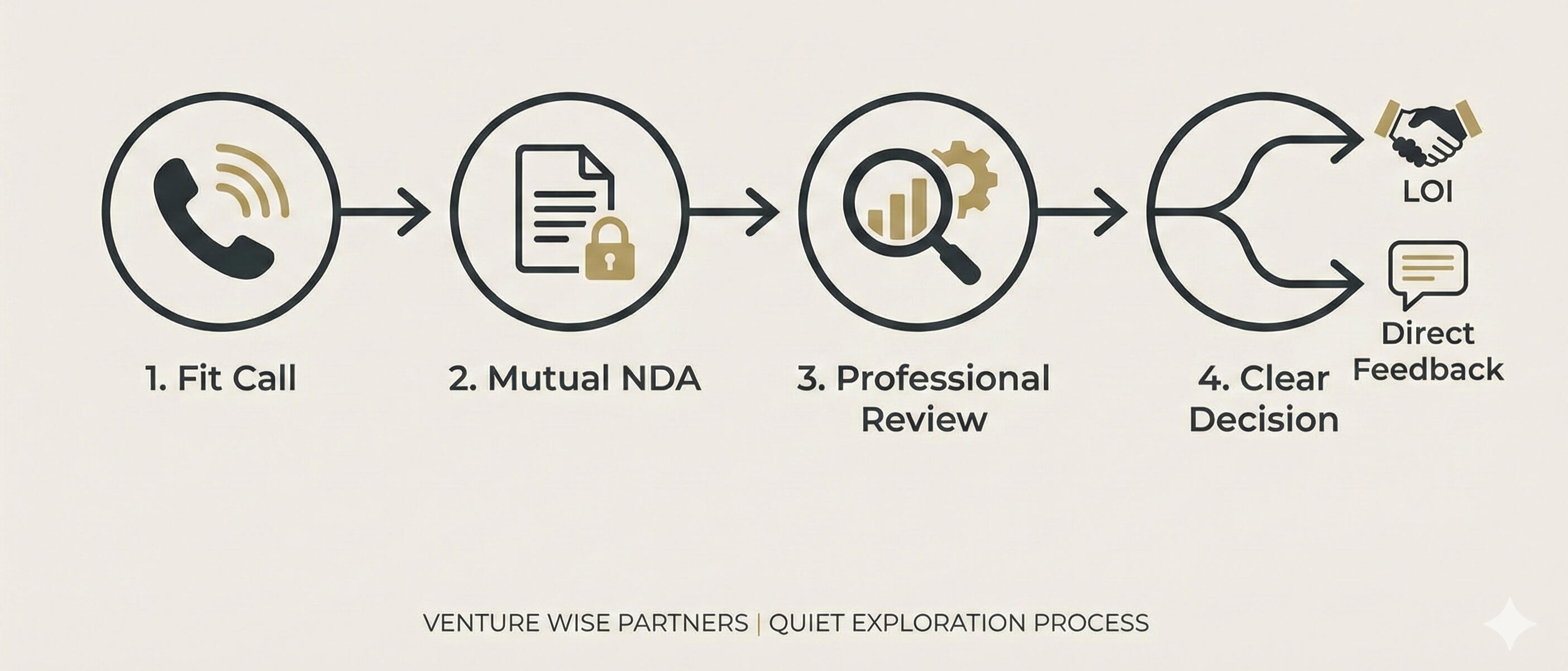

How It Works

A disciplined, four-step process designed to protect your time and your privacy.1. The 30-Minute Fit Call: A high-level conversation to discuss your objectives and see if our criteria align.2. Mutual NDA: We execute a formal Non-Disclosure Agreement. Your sensitive data never leaves our firm.3. Professional Review: I conduct a rapid analysis of your financials and operations to determine a fair market valuation.4. Clear Decision: We either move to a Letter of Intent (LOI) or I provide direct feedback on why it isn't a fit. No dragging out the process.

FAQ

The Sale Process & ValuationHow is the purchase price calculated?We typically use a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or Revenue to determine enterprise value. We also factor in your market position, the strength of your management team, and historical growth trends.What if I don't have a formal business valuation yet?You don't need one. We conduct our own internal valuation during the "Professional Review" phase, using your financial data to provide an accurate market assessment without any cost to you.What documents will I need to provide?Initially, we only need the last three years of profit and loss (P&L) statements and balance sheets. If we move forward, we will look into tax returns, customer concentration, and employee data during due diligence.Confidentiality & RiskWhat happens if the deal doesn’t close after I share my data?This is why the Mutual NDA is signed before any sensitive data is exchanged. Legally, we are prohibited from sharing your information or using it for any purpose other than evaluating the acquisition.When do my employees and customers find out?Typically, not until the deal is finalized and legally "closed". We work with you to draft a communication plan to ensure the transition is announced in a way that maintains trust and stability.Your Future Role & TermsDo I have to stay on after the sale?This depends on your goals. Some owners prefer a "clean break," while others stay on for a defined transition period (3–12 months) or even remain as a minority partner to help grow the business further.What is an "earn-out" and will my deal have one?An earn-out is a structure where a portion of the purchase price is paid later, contingent on the business meeting specific performance targets. We discuss these terms transparently early in the process so there are no surprises at closing.Are you buying the whole company or just a part of it?We specialize in majority buyouts, meaning we typically acquire 51% to 100% of the company. However, we are open to structures that allow you to "roll over" a portion of your equity to benefit from the business's future growth.

SEND THE BASICS

To provide a direct and confidential "Fit Assessment," please share these high-level details. This information helps me determine quickly if your business aligns with our acquisition criteria before we proceed with a formal introduction.Industry:Annual Revenue (LTM):Annual Profit (EBITDA):Primary Goal: (e.g., Retirement, Partner, Growth)Management: Can the business run without your daily involvement?

Privacy Note: You do not need to provide your company name or sensitive trade secrets at this stage. This data is used solely to determine if your business meets our initial acquisition criteria. All submissions are protected by our firm's strict confidentiality standards.

Thank you

Submission Received. Your privacy is our priority.Thank you for sharing the basics of your business with Venture Wise Partners. We understand the weight of this decision and treat your information with the highest level of professional discretion.What happens next:Review: I will personally review your data against our current acquisition criteria within the next 48–72 hours.Contact: If there is a potential fit, I will reach out via your preferred contact method to schedule a brief, 30-minute introductory call.Discretion: If it isn't the right match at this time, I will inform you quickly so you can remain focused on your operations.

WHY US

Who We Are At Venture Wise Partners, our leadership team provides specialized exit and acquisition strategies to help owners transform years of business growth into a secure financial legacy.

Venture Wise Partners is a dynamic firm of seasoned investment and operational professionals dedicated to providing tailored acquisition solutions that drive long-term stability for businesses of all sizes. With expertise in navigating complex transaction environments, we help owners move past the uncertainty of a traditional sale and toward a professional, principal-led exit. Whether engaging in high-level negotiations in the boardroom or providing hands-on transition support in the field, we deliver strategic outcomes designed for lasting impact. Headquartered in Boca Raton, Florida, we partner with privately held businesses to unlock their full value while building a foundation for the company’s continued scalability and success.Direct Accountability. No Intermediaries. When you work with us, you aren't dealing with a junior associate or a commission-driven agent. You are dealing directly with the decision-makers.Principal Investment: We are the buyers, not a brokerage. Our focus is on the long-term health of the acquisition, not a transactional listing fee.Operational Respect: We understand that your business is more than a set of spreadsheets. We prioritize the legacy you’ve built and the people who helped you build it.Radical Transparency: If a deal doesn't make sense, we will tell you immediately. We value your time as much as our own—no "maybe" and no moving goalposts.Proven Discretion: Our reputation is built on closed-door successes. I have no interest in publicizing your intent to sell until the transition is complete and the future of the company is secure.What We Can Do For YouOur approach is designed to move beyond theory and into execution. We provide:A Direct Path to Liquidity: We provide a clear, streamlined exit without the need for public auctions or "teaser" blasts to competitors.Operational Continuity: We ensure the business continues to run smoothly after the sale, maintaining customer trust and employee morale.Flexible Transaction Structures: Whether you want a total exit or a phased transition, we create a deal structure that aligns with your financial and personal goals.